For many young Australians, managing their Higher Education Loan Program (HELP) debt—still widely known as HECS—and saving for a home are major financial priorities. However, understanding whether to prioritize paying off educational debt or investing in real estate is not straightforward, especially considering the impact of HELP debt on borrowing capacity. Here’s a breakdown of the options available and how your local Morbanx mortgage broker can guide you through these complex decisions.

Understanding HELP Debt

HELP debt is unique in that it’s indexed to inflation, meaning its value increases annually based on changes in the cost of living, measured by the Consumer Price Index (CPI). For instance, a significant indexation rate of 7.1% was applied in June 2023, the highest since 1990, which can considerably increase the total amount owed over time.

The Impact of HELP Debt on Borrowing Capacity

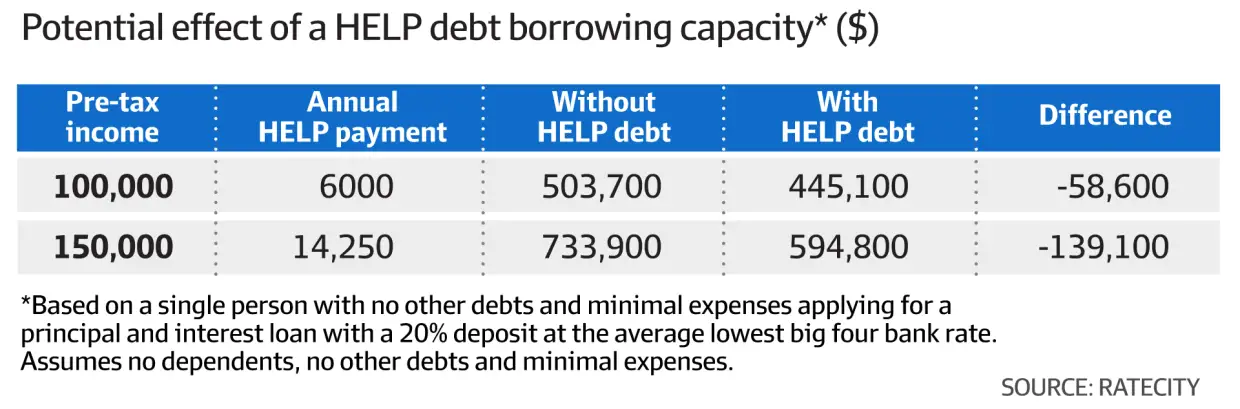

HELP debt can significantly reduce a potential homebuyer’s borrowing capacity. For example, having a HELP debt of between $100,000 and $150,000 can decrease your borrowing power by approximately $58,000 to $150,000, respectively. This is because lenders consider monthly or yearly debt repayments as part of your liabilities when assessing how much you can borrow.

Option 1: Paying Off HELP Debt

Pros:

- Reduced Debt-to-Income Ratio: Paying off HELP debt can improve your debt-to-income ratio, making you a more attractive candidate for lenders.

- Increased Borrowing Power: With less debt, you can potentially qualify for a larger mortgage.

- Peace of Mind: Eliminating debt can reduce financial stress and simplify your financial situation.

Cons:

- Less Cash for Down Payment: Using savings to clear HELP debt might mean less available cash for a home deposit, potentially delaying property purchase.

Option 2: Saving for a Home

Pros:

- Capitalizing on Property Market Growth: Investing in property sooner can capitalize on market appreciation, especially in areas with high growth rates.

- Building Equity: Owning a home allows you to build equity as opposed to spending money on rent.

Cons:

- Lower Borrowing Capacity: Holding onto HELP debt means you may qualify for a smaller mortgage, which might limit your property options.

- Higher Debt Levels: Carrying both mortgage and HELP debt can be financially straining, especially if interest rates rise or personal circumstances change.

How a Mortgage Broker Can Help

Mortgage brokers are invaluable in navigating these decisions due to their expertise and access to a wide range of products and lenders. Here’s how they can assist:

- Comparative Analysis: A broker can provide a detailed analysis of how different scenarios affect your financial health, including comparisons of how much you can borrow with and without your HELP debt.

- Tailored Recommendations: Based on your financial goals and situation, a broker can recommend whether to pay off HELP debt or save for a home, considering both current market conditions and long-term financial planning.

- Access to Better Deals: Brokers often have access to better mortgage rates and terms that might not be widely advertised, potentially saving you money even if you choose to keep your HELP debt.

- Strategic Financial Planning: They can offer strategies to balance paying off debt and saving for a deposit, such as refinancing options or finding properties that fit your reduced borrowing capacity.

Deciding between paying off HELP debt and investing in real estate depends heavily on individual circumstances, financial goals, and market conditions. Talk to your broker at Morbanx. They can play a crucial role in assessing all factors and guiding you through making the best decision to align with your financial aspirations. Whether reducing debt or entering the property market, having expert advice can ensure you make informed and strategic financial decisions.